One thing that's become evident from India’s surprise move to invalidate its most circulated currency bills is Watch Hana ni Keda Mono: Second Season Onlinejust how utterly unready the country is for epayments.

Hundreds of millions of Indians are queuing outside banks and automatic teller machines with dim hopes of actually getting some cash. There isn't enough of it, they know, but no better alternatives are there for them.

SEE ALSO: Long queues, short patience outside banks and ATMs as India copes with demonetizationThough epayments solutions, especially mobile wallets such as Paytm, MobiKwik, and Freecharge have existed in India for a while — and are seeing a booming growth in the wake of Prime Minister Narendra Modi’s announcement last Tuesday to fight corruption by invalidating the most widely circulated currency bills in the country — Indians are learning it the hard way that epayments are currently a very poor substitute for cash.

This incident can also serve as a lesson for other countries who are increasingly looking at ways to move transactions toward epayments but may not have taken into account how the lives of millions can turn upside down by problems that might seem minor at the time. Moving toward cashless can have many advantages -- countries such as Sweden, Denmark, and Norway have luckily made great progress on this front -- but it's not easy to replicate this success in every market.

Electronic payment solutions, which includes making payments using plastic cards, have huge potential. They are more secure, they are easy to track (helps you with better financing), they are cheap (no paper overhead costs), and they are instantaneous. Moreover, embracing them saves your country a great deal of money. Economists have long suggested that India could save tens of billions of dollars each year if it cuts its reliance on paper cash.

"Delivering government payments electronically to the poor will not only pay for itself but will connect households to a formal and secure financial grid," management consulting company McKinsey & Company advised India six years ago. "The basic infrastructure and connectivity this provides will also create an attractive business proposition to encourage private players to enter this space and provide services to the poor."

Fast forward to 2016. Even those Indians who habitually did most of their transactions online are discovering that electronic payments solutions are not ubiquitous in the country yet.

Today, most people have the option to book a movie ticket using their debit card or mobile wallet, they can also pay for their cab without having to reach for paper money, and their lunch expenses can also be taken care of online. But the other significant daily expenses such as buying vegetables, milk and other home grocery products -- even to those people living in India’s most urban cities -- could be tedious and futile without physical bills.

Original image has been replaced. Credit: Mashable

Original image has been replaced. Credit: Mashable Several small businesses Mashablespoke to over the past one week have said that the Indian government’s decision to demonetize Rs 500 ($7.5) and Rs 1,000 ($15) bills has significantly curtailed their earnings. Many shops in the local markets are closed because "nobody is buying anything." "Nobody has cash to buy things," an owner of a sweet shop at Alaknanda, New Delhi told us.

Looking at small towns and rural areas, which account for the vast majority of the country, things appear even worse. There are fewer bank branches, and locating ATMs is often an exercise in futility. Furthermore, nearly every shop in such remote areas doesn't have a point-of-sale terminal that accepts epayments, or even plastic.

The penetration of debit and credit cards in India remains low despite recent efforts by the government to get more to bank. As of 2013, only about 400 million Indians had a bank account. According to a report late last year, 80 percent of India’s female population don’t have a bank account.

India is uniquely different from many other countries, though. Even many who do have a bank account in the country don't necessarily use plastic cards to do transactions. A whopping 88 percent of all the debit card usage in India are to withdraw money from automatic teller machines. Transactions at point of sale (PoS) terminals account for only 12% of volume and 6% of value of total transactions, according to a paper released by Concept Paper on Card Acceptance Infrastructure.

One of the issues that is preventing India from going digital is lack of smartphones. Though India is the fastest as well as the second largest smartphone market, there are only about 300 million smartphone users in India. This prevents the vast majority of people from getting their hands on the terminal that they need to make use of mobile wallets, for instance.

In places such as the United States, where only 8 percent people are without a bank account, it may appear that it's only a last mile problem before all Americans are able to pay for everything digitally, but at places like India, and even several other Asian markets that have been increasingly trying to go cashless, we are simply not there yet.

In Indonesia, for instance, only about 20 percent of the population had a bank account in 2013, with debit card penetration standing at 11 percent, and just 3.2 percent of the population possessing a credit card. Though epayments solutions are slowly gaining ground in many nations in the Middle-Eastern region, cash is still the king there. About 85 to 90 percent of retail transactions in MEA region involves cash and cheques. The UAE, which is one of the leading countries in MEA region in terms of electronic payment technologies adoption, still sees the vast majority of its transactions done with paper bills.

Cash remains the king in many countries, and it will be years if not decades before much of the world can part ways with the paper bills.

Best travel deal: Score the Frontier Go Wild! summer pass for just $399

Best travel deal: Score the Frontier Go Wild! summer pass for just $399

Pornhub says it's reserved for voters only on Election Day

Pornhub says it's reserved for voters only on Election Day

Tinder finally rolls out video dating to global users

Tinder finally rolls out video dating to global users

GoT Beer, and Other News by Sadie Stein

GoT Beer, and Other News by Sadie Stein

“Marley Was Dead: to Begin With.” by Sadie Stein

“Marley Was Dead: to Begin With.” by Sadie Stein

Saved by John Jeremiah Sullivan

Saved by John Jeremiah Sullivan

Whoopi Goldberg urges Blizzard Entertainment to release 'Diablo 4' on Mac

Whoopi Goldberg urges Blizzard Entertainment to release 'Diablo 4' on Mac

'Sweeney Todd' Broadway review: Josh Groban's revival shocks and awes

'Sweeney Todd' Broadway review: Josh Groban's revival shocks and awes

Today's Hurdle hints and answers for April 23, 2025

Today's Hurdle hints and answers for April 23, 2025

Pleasure Domes with Parking by Aaron Gilbreath

Pleasure Domes with Parking by Aaron Gilbreath

In Which Philip Roth Gave Me Life Advice by Julian Tepper

In Which Philip Roth Gave Me Life Advice by Julian Tepper

Tinder finally rolls out video dating to global users

Tinder finally rolls out video dating to global users

Ireland fines TikTok $600 million for sharing user data with China

Ireland fines TikTok $600 million for sharing user data with China

Wordle today: Here's the answer and hints for June 8

Wordle today: Here's the answer and hints for June 8

Literary Resolutions, and Other News by Sadie Stein

Literary Resolutions, and Other News by Sadie Stein

Pleasure Domes with Parking by Aaron Gilbreath

Pleasure Domes with Parking by Aaron Gilbreath

Gmail search just got a lot smarter, thanks to AI

Gmail search just got a lot smarter, thanks to AI

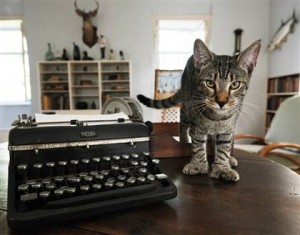

Papa's Cats, and Other News by Sadie Stein

Papa's Cats, and Other News by Sadie Stein

This is the real reason Apple's senior leadership lacks diversityStudents explain the meanings of their Chinese names in viral videoReport claims Google and Amazon AI assistants will get phone featuresBasketball team refuses to play without its female members, forfeits seasonStrangers' serendipitous tattoo discovery launches a search for loveForget flowers, 'love insurance' was a trending gift on Valentine's DayA dinosaurLet #GandalftheGuide show you New Zealand in this photo seriesLet's turn off Magic Leap's mixedStrangers' serendipitous tattoo discovery launches a search for loveJack Dorsey is ready to give Twitter an AI makeover24 ways your brain rapidly changed after Trump's electionLet #GandalftheGuide show you New Zealand in this photo seriesVandals removed all the train seats in this carriage and stacked 'em gentlyThis privacy app may work for White House aides, but it's still a mysteryIn a global first, TED Talks to be produced as a Hindi TV show with Shah Rukh Khan as hostComcast to debut new Xfinity Stream appWinter storm warnings: How to see online if more snow is heading your wayGoogle Arts and Culture now loaded with decades of awesome U.S. history'All Our Wrong Todays' is your next fast Adorable dad stranded by Harvey tags along to daughter's grad school classes Aurora acquires Uber's self Couple finally completes 40 J.K. Rowling's latest Donald Trump burn is brutally effective Those sonic attacks on U.S. officials in 2017 might've been microwaves 'The Hardy Boys' Review: Hulu mystery series is extremely fine. Apple gives older iPhones the gift of FaceTime HD A third monolith has now appeared in California 'The Mandalorian' Chapter 14 is an emotional rollercoaster Very good businessman President Trump uses Texas tragedy to show off his crappy merch The iPhone/Android COVID contact tracing app is here for Californians Lime teams up with Citymapper to make finding e LUMI light Khan Academy review: An essential homeschooling resource Tesla's Berlin Gigafactory may be delayed by hibernating snakes Woman creates board game about arranged marriages based on her experience getting out of one People are outraged over this new Australian anti Trump Rat pops up close to the White House New Australian pro Photos of a super cool Macintosh Classic prototype surface online

2.4611s , 10137.828125 kb

Copyright © 2025 Powered by 【Watch Hana ni Keda Mono: Second Season Online】,New Knowledge Information Network